Donald Trump Still A Miser, Tax Return Shows

Tycoon's foundation again staked by tix scalper

View Document

NOTE: TSG, which first reported on the Trump Foundation in November 1999, published lengthy stories on the tycoon’s, um, charitable activities in April 2011 and November 2015.

JANUARY 15--For the sixth straight year, Donald Trump made no contributions to his own charitable foundation, instead relying on a hefty contribution from a New York City ticket scalper to underwrite the group’s activities, according to a new Internal Revenue Service filing.

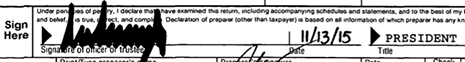

The Donald J. Trump Foundation’s 2014 tax return, which the billionaire signed and filed two months ago, shows that the organization donated only $591,450 that year, the lowest amount since 2003, when the billionaire made just  $187,725 in charitable contributions.

$187,725 in charitable contributions.

The miserly Trump, whose paltry philanthropy has long been chronicled in these pages, made 53 separate donations in 2014, the largest of which, $100,000, went to the Citizens United Foundation, the Washington, D.C.-based conservative advocacy group.

Trump’s foundation also gave $25,000 to the publisher of the conservative American Spectator, and $50,000 to the Manhattan school attended by his nine-year-old son Barron (the private Columbia Grammar and Preparatory School got $50,000 in 2012).

Other recipients of 2014 Trump donations include the Sports Hall of Fame of New Jersey ($5000), the New York Jets Foundation ($10,000), and charities affiliated with retired New York Yankee Mariano Rivera ($4000) and golfer Jack Nicklaus ($25,000). Trump also gave $5000 to the Palm Beach Opera and $10,000 to New York’s Labyrinth Theater Company ensemble.

IRS records show that the last time Trump personally deposited funds into his eponymous foundation was 2008, when he cut the organization a check for $30,000.

Since that time, the GOP presidential candidate has used other people’s money to fund his foundation’s minimal efforts.

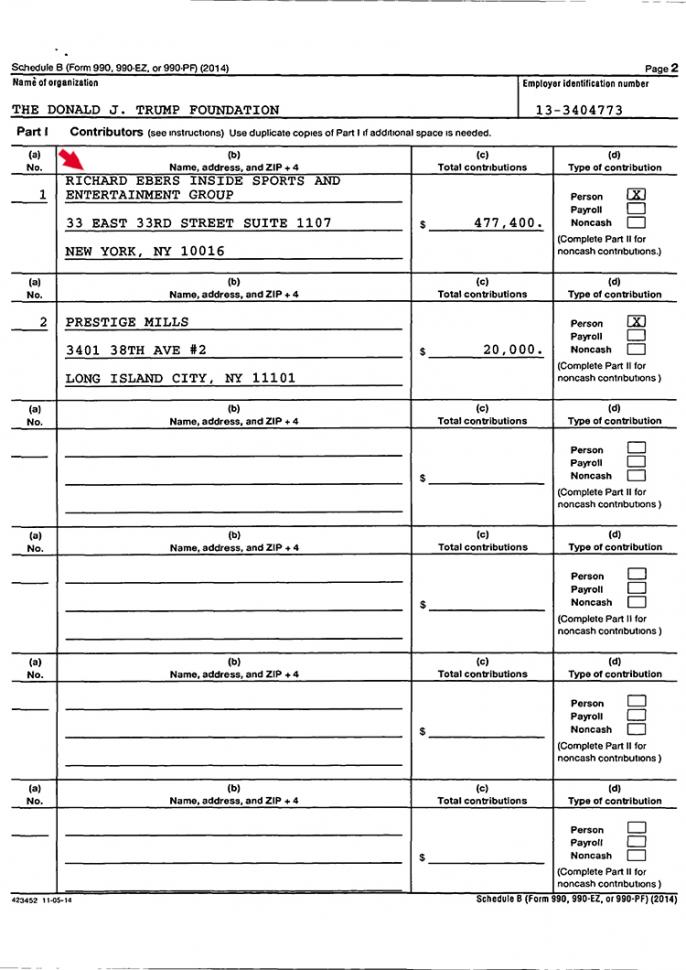

The Trump Foundation’s latest tax return shows that the group received two contributions in 2014. Prestige Mills, a wholesale carpet firm headquartered in Queens, gave $20,000. The second donation, for $477,400, is credited to “Richard Ebers, Inside Sports and Entertainment Group.”

Since 2011, Ebers has donated nearly $1.9 million to Trump’s foundation, according to IRS returns. When contacted recently by TSG, Ebers declined to comment about his hefty contributions to Trump. In a 2011 New York Times profile, Ebers was referred to as “The Ticket Man,” a white-collar scalper who peddled premium seats to concerts, sporting events, and even the Westminster dog show.

It is unclear whether the Trump donations were given by Ebers personally, or came from his employer. Inside Sports & Entertainment Group is a corporate hospitality, event management, and marketing firm owned by Creative Artists Agency.

Since Trump has shown a deep aversion to funding his own foundation, the Ebers donations--as well as those received in prior years from the World Wrestling Federation ($5 million), NBC Universal ($500,000), and Comedy Central ($400,000)--allow the business magnate to maintain an illusion of philanthropy without actually having to reach into his own pocket.

When asked Sunday on NBC’s “Meet the Press” why he had declined to sign the “Giving Pledge,” a philanthropic initiative spearheaded by Bill Gates and Warren Buffett, Trump replied that he was “a little bit old-fashioned” and wanted his children to keep his company going, “as opposed to selling everything and giving it away.”

Trump said that he wanted to see his firm “go on for a long time, creating jobs, lots of money, pay lots of taxes, give lots of money away. I make lots of big contributions. I like that better.”

Those purported “big contributions,” which Trump did not further describe, appear to be made exclusively via the Donald J. Trump Foundation. Until Trump releases his personal tax returns, the true level of his charitable giving will remain unknown. (4 pages)